So What is the Good News?

I'm going to print the comment here because I think it exemplifies one of the basic points that I refer to from time to time which is that this economic expantion is not benfiting the average American.

I guess this would be good news. I heard from an old friend a few days ago, I hadn't talked to him in over twenty years. He is now buying and selling (high$) homes in the Daytona Beach, Florida area. Sounded to me like he was doing very well for himself. He said that I have a place to stay anytime I'd like to come for a visit.Sounds like a plan to me.When we were talking it was 80 degrees in Florida, it's suposed to snow in Missouri tomorrow. All I need to do is come up with the needed gas money to drive a 1993 half ton Chevy pickup (4x4) from Missouri to Florida.

Now I don't mean to say that David is an average person.... not by a long shot. But as you can see from the post, he is an American with an average income. He works hard to support his family. His friend on the other hand, has been making huge cash, and even if the economy takes a turn for the worse, his friend will still be sitting pretty. David, on the other hand, is likely to have his hours cut, or maybe he will even lose his job if the economy takes a sudden turn for the worse. But hey, at least his rich friend will put him up for a good time in Daytona Beach. I guess those of us who aren't rich can expect that our rich friends will help us out when the time comes..... but I wouldn't count on it.

So, did we get any good news this week so far? Well, Q3 GDP was revised upwards to 2.2% from an initial reading of 1.6%. That is good news (if you own stocks). Bernanke made a very upbeat report on Tuesday to the Italian American Association about the health of the economy, assuring all the rich people at the luncheon not to worry about the slowing growth because it is a natural for it to slow in this stage of an economic recovery. However, Bernanke warned that inflation is still a concern.

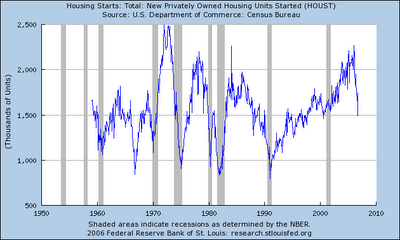

Consumers however don't seem to share Bernanke's optimistic view. Although new home sales came in higher than expected, prices are dropping rapidly. The drop in prices is what is fueling increased sales, and the real price drop (as Bernanke explained) is much more than the numbers indicate because sweateners offerered by the builders are not included in the price data. Builders are offering more free items than ever before, but there is no way to measure that on an official basis. Furthermore, inventories remain quite high and cancellations are not added into the inventory numbers.

Sales of durable goods were down nearly 9% in October, and consumer sentiment is softening accross the board. Today's data on initial jobless claims sent up some red flags as well. While the market expected claims to come down to about 312K from last week's 321K, the number came in at 357K and last week's number was revised slightly upward to 323K. This is two weeks in a row when actual jobless claims were higher than expected. If we get a similar surprise next Thursday, expect the mother of all data (Non-Farm Payrolls) to come in well under the expected 145K on Friday next.

The market had expected the PCE core deflator (the Fed's favorite measure of inflation) to ease slightly to a 2.3% year on year pace, but it came in the same as last month at 2.4%. Thus, as the job market tightens, and consumption eases, inflation remains the same. To make matters worse, the Chigago PMI (a regional manufacturing survey) came in well under expectations at 49.9. This is crucial because the 50 level means economic stagnation. All eyes will be on the nation-wide ISM number which is released tomorrow. The market is now gearing for a disappointment because of the Chicago data coming in below the Mason-Dixon line of 50 (if only just) for the first time in almost 4 years.

So as a result, the dollar has lost another 1.5 cents to the Euro. It will now cost you $1.3250 to buy one Euro, and $1.97 to buy one U.K. Pound (a 14 year high). The dollar index is down almost 10% in one year, and the dollar has lost 6 cents to the Euro in one month. It looks like we are racing to the all time high (or low if you are an American) of $1.3667 with reckless abandon. The Dow also took a fairly sharp drop on the Chicago PMI news. If the nationwide ISM index number reflects the Chicago reading from today, expect further losses for both the dollar and the Dow.

Furthermore, the ten year note dropped below 4.5% which can not be emphasised enough. If this closes the week below 4.5% the Fed is in quite a spot. The inversion of the yield curve is now at .75% and despite all the Fed's warnings to the contrary, the market still believes that the Fed will lower rates soon. However, without some relief from the inflation data, this will be impossible.

And last but certainly not least, oil has popped back up above $63 on news of a sharp drop in gasoline and heating oil inventories. A cold winter could put further upward pressure on oil prices which will further drive inflation.

Put simply, despite evidence of a slowing economy and a weakening housing market, the Fed will be unable to reduce lending rates, as the market expects it to, due to inflation pressures. As it becomes clear that the Fed will not cut rates, there will be serious fallout for the equities market and the housing industry. Both the Fed futures market and the Bond market expect a rate cut, and in fact more than one. I can't imagine that I am smarter that the market, but I just don't see how the Fed can justify a rate cut until inflation pressures start to ease.

What am I missing here?