Time to Worry

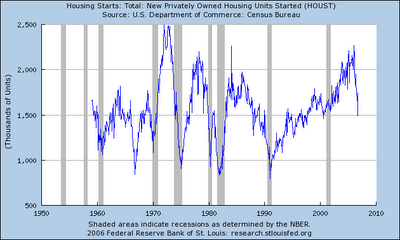

This chart shows the annual rate of new housing starts in the U.S. The shaded areas are recessions.

Last month, a slight upturn led many conservative economists to claim the housing market was stabilizing. They have since changed their tune. Alan Greenspan also claimed that the worst was behind us, but left the caveat that the housing downturn was not over. He was half right.

Even the most pessimistic analysts were surprised at October's tragic numbers. The market had expected a reduction in housing starts and permits, but the actual numbers were off by over 3 times what was predicted and were accompanied by downward revisions to August and September's numbers. This leaves housing starts down 27% year on year and an incredible 34% decline has been witnessed since the January 33 year high.

Last month I said, "The housing market continues to weigh on markets and I expect that effect to accelerate over the next few months." Well, I was half right. The housing market should be weighing on markets because it's performance is worse than anyone predicted, but yet the Dow continues to set new records.

The Dow is in uncharted territory which renders technical analysis nearly useless. The Bollinger band has been broken and there isn't really any technical resistance left to stop this bull run. Furthermore, as investors fear the housing market, the Dow becomes a more attractive option.

How far can this go?

I will be surprised if the Dow breaks 12,500, but the one thing I have consistently underestimated is the resilliance of the U.S. equities market. Still, I think we are getting very near a top, and although a big correction is unlikely, I think most investors will be happy if the Dow finishes the year above 12,000.

The good news is that thanks to a drastic drop in oil prices, which continued Friday, inflation data is allowing the Fed to put off any more rate hikes. Currently the Fed futures market predicts a rate cut around June of 2007 and one more cut, to 4.75%, by the end of 2007. With the latest housing data, the odds of these cuts kicking in are increasing. Let us hope that energy prices continue to moderate. This should help keep inflation in check and may allow the Fed to cut rates. Otherwise, we haven't even begun to see the bottom of the housing market.

8 Comments:

I am economically challenged.I have trouble with it. So i appreciate a good analysis. i have read by a lot of people that the housing market is looking bad

By Graeme, at 7:07 PM

Graeme, at 7:07 PM

You know, I couldn't get my head around basic concepts until much later in life. Give it time, it will sink in.

By Praguetwin, at 8:56 PM

Praguetwin, at 8:56 PM

WILL TO DOOM - WILL TO DOOM - WILL TO DOOM! (maybe if we all chant it will happen)

By Anonymous, at 3:15 PM

Anonymous, at 3:15 PM

There is a difference in willing something to happen than watching something happen.

By Praguetwin, at 3:43 PM

Praguetwin, at 3:43 PM

Not every housing starts decline on your chart was associated with a recession. I'm hearing that the builders are gearing up for a spring building drive, so maybe we'll escape this time as well. Besides, with Democrats now in control of Congress, how could there possibly be a recession?

By Roger Fraley, at 7:20 PM

Roger Fraley, at 7:20 PM

PT

So how much longer do I have to wait? When is this thing that you claim is happening actualy going to happen??? Can you put a time frame on it for me???

By Anonymous, at 7:21 PM

Anonymous, at 7:21 PM

Roger,

You are quite right. The point is that the builders and the others had all said that we had hit the bottom last month and then we got record new numbers. The recession is far from assured, but we are also far from being out of the woods as well.

Even if the Democrats engaged in perfect policy, (which of course they won't or will they have the opportunity to do until next year) the fundamentals are already in place. There is little that can be done now. Oil price will be the key going forward as that is what has been driving inflation. Should that moderate, we could have the soft landing, if not, Fed rate decsions could end up sending us into the not-so-happy place.

By Praguetwin, at 9:35 AM

Praguetwin, at 9:35 AM

Arch,

If I could put a date on it, I wouldn't have to work. My only point is that the rosy scenarios that the right-leaners (like yourself) have been espounding of late have some serious holes in them that ought to be examined. But if you choose to ignore the warnings, by all means, go ahead and invest. Get another mortgage and show us all how stupid we are and retire in ten years on your profits. You can laugh all the way to the bank.

Essentally, as I am fond of saying, put your money where your mouth is, and please do not tell me about the equity markets or your 401k. The equity markets are completely divorced from the housing market and as I pointed out in the post, actually benifit from the decline in the housing section as investors choose equities to invest in instead of housing.

Also, you live in California, and thanks to several factors, your market is somewhat insulated. It will be places like Phoenix that will be hardest hit should the most dire predictions come true.

I doubt that the most dire predictions will come true, but I think there are some serious issues just around the corner which will put pressure on financial institutions as well as building companies (the latter leading to the former).

By Praguetwin, at 9:51 AM

Praguetwin, at 9:51 AM

Post a Comment

<< Home