Mother of All Data

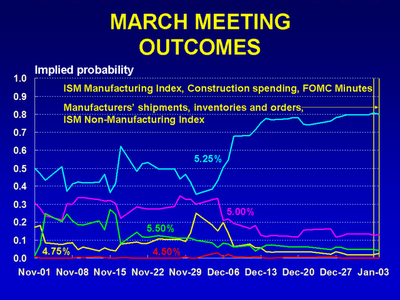

What you see here is the diminishing possiblility (largely over the last month) that the Fed will cut rates anytime soon.

Inflation concerns and strong job growth are the reasons why. I've thought this for quite a while, but it seems the odds makers are starting to catch up. I stand by my statement that the fed will not cut rates before June of '07.

The Non-Farm Payrolls report showed an increase of 167K jobs in December. November's number was revised upward by 29,000. This is the first really good news out of the U.S. in quite a while. There have been some encouraging home sales numbers lately, but inventories remain dangerously high. Further softness in construction hiring is expected as a result.

Auto sales continue to disappoint but the Institute for Supply Management report shows a slight expantion in December in the manufacturing sector. The barely positive 51.4 reading comes as a relief as the November ISM came in under the 50 level indicating that manufacturing as a whole was contracting. The December Non-Manufacturing report was more upbeat indicating that the service industry is still expanding at a pretty decent clip (57.1).

Getting back to the "mother of all data releases", the NFP report, it is clear now that the Fed will not be lowering rates anytime soon. Average hourly pay increased by .5% which will increase inflation fears. Despite all the talk about the Fed having to step in to save mortgage holders, banks, Freddie Mac (who posted $550 million in losses in Q3), and Fannie Mae, the Fed has repeatedly said that inflation is it's top concern. So as time goes by we see the probability of a rate cut decreasing. Partially because slightly better economic data is coming in, but more importantly because inflation concerns remain.

So despite the rapid drop in oil prices of late, the equity markets are looking a little jittery with the realization that the Fed will not cut rates anytime soon finally starting to set in. Furthermore, the nearly 6 month rally in equities looks to be showing some fatigue, with volotility on the rise, and the new record highs above 12,500 looking like a mid-term top.

8 Comments:

Sounds right to me, but of course that is like a bear saying he liked Bach over Brahms. I'm slightly more optimistic that the rates will get cut sooner, but that's because I want them to. Good, solid posting, Mike.

By Roger Fraley, at 10:27 PM

Roger Fraley, at 10:27 PM

It is the bottom of the market that is really telling. Job growth is one thing, but means little if wages are still below or nudging the poverty line.

Of more concern should be the increase in bankruptcy and schemes of arrangement.

In Australia the numbers are up 15.4% for the last calendar year. An indicator in the US is the D&B fee hike of over 200% to make up for lost volume.

People are hurting, regardless of the 'markets'.

By Cartledge, at 11:37 PM

Cartledge, at 11:37 PM

Thanks Roger,

You and the equity traders both.

Cartledge,

D&B fee hike? I think we will see major fallout, slow but steady, in the housing sector as rates stay where they are. As the ARMs start to turn over (2007 will be big) people are going to get hurt, but only the careless for the most part (read over leveraged).

Average hourly earnings are up over 4% this year now, and job growth is basically keeping up with population growth. Read that as, inflation concerns persist but overall growth is mild.

By Praguetwin, at 7:36 AM

Praguetwin, at 7:36 AM

As the ARMs start to turn over (2007 will be big) people are going to get hurt, but only the careless for the most part (read over leveraged).

The "over-leveraged" includes just about everyone out here on the Left Coast of the United States. Forclosures rates are already on the rise and poised to explode in 2007.

This year looks to be messy.

By Anonymous, at 5:28 PM

Anonymous, at 5:28 PM

Somewhere (on the radio) today I caught the tail end of something about oil prices going up. I hope not. So far it has been warm here but we all know it is winter.

God Bless America, God Save The Republic.

By David Schantz, at 6:59 AM

David Schantz, at 6:59 AM

To demonstrate my ignorance...

Are ARMs just the balloons (where, surprise!, you have to pay all the mortgage back right now and your credit sucks so you can't refinance), or is it the fluxuating deal.

We've been getting calls from...someone. He's convinced we'll lose our house unless we refinance with him, right now. It's scammy or, at least, smarmy, but he's persistent. He keeps talking about fluxuations...but all I know about is the balloon deal, which I know is bad and I know we don't have one.

All I really know is that they can't take our house (shy of that eminent domain crap...which doesn't apply) if we're paying our mortgage every month, on time each time since we got the house. And that student loans don't count as income.

By Mark, at 7:40 AM

Mark, at 7:40 AM

Kvatch,

I don't even want to ask some of my friends who got in late what their situation is. Messy indeed.

David,

Oil was caught in a $58-$62 range for the last couple of months. Lately it has been dropping because of the mild east-coast winter. That could change.

Stephanie,

ARM is short for "Adjustable Rate Mortgage." There are many types, including but limited to the baloon payment type that you talk of. Hopefully you have a fixed-rate mortgage, in which case you are absolutely right: just pay the payment and you are fine. Tell the huckster to stick it where the sun don't shine.

What a lot of people did is borrow as much as they can with a 2 year fixed loan at a very low rate (say 4%). Then after two years, the rate becomes something like prime plus 1.5% (currently that would be 6.75%). So everything is fine until that day comes and suddenly their payment doubles.

By Praguetwin, at 10:23 AM

Praguetwin, at 10:23 AM

"What a lot of people did is borrow as much as they can with a 2 year fixed loan at a very low rate (say 4%)."

Well, that's certainly not what we did...so I'll just tell him to stop calling (politely, though) and hope he does.

By Mark, at 3:58 AM

Mark, at 3:58 AM

Post a Comment

<< Home